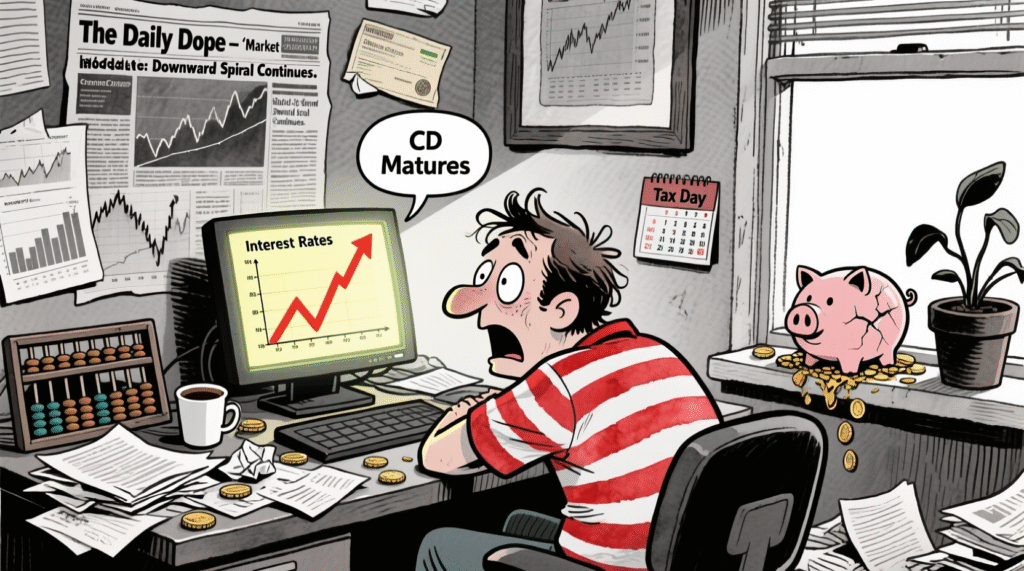

The notification arrived. The rate was high. And then… the Fed whispered: “Not for long.” In this honest unboxing, we dissect the cd account matures before rate cuts crisis — where a simple financial decision becomes a full-blown identity moment, and the only thing more volatile than interest rates is your emotional state. Spoiler: yes, the universe is mocking you.

🔽 Table of Contents

- What They Promise: Stability, Growth, and Peace of Mind

- What It Actually Is: Financial Whiplash

- The Top Options: A Painful Countdown

- The Hidden Costs: Your Sanity, Your Time, Your Dignity

- Who Is This For? A Field Guide to the Rate-Anxious

- Conclusion: You Can’t Time the Market — But You Can Breathe

🏦 What They Promise: Stability, Growth, and Peace of Mind

We were sold a dream: Certificates of Deposit are the safe haven of personal finance — where your money grows while you nap.

Not “a trap.” Not “a timing nightmare.”

No — this is smart saving. A low-risk investment. A chance to prove you’re not one of the “crypto lunatics”.

Bank websites declare: “Lock in today’s high rates!”

Meanwhile, financial advisors say: “CDs are perfect for conservative investors.”

And one banker told us: “If you panic, you’ve already lost.”

The promise?

If you trust the cd account matures before rate cuts system, you win.

As a result, you grow your savings.

Ultimately, you unlock the right to say: “I didn’t chase yield. I waited.”

And of course, there’s merch.

You can buy a T-shirt that says: “I Survived the Great Rate Drop Panic” — available in “I Should’ve Reinvested” beige.

There’s a “CD Decision Wheel” app (spins to “withdraw,” “reinvest,” or “cry”).

On top of that, someone launched RateCoin — backed by “the volatility of indecision.”

This isn’t just banking.

It’s a test.

It’s a ritual.

Above all, it’s a way to turn a 1% interest decision into a full-blown midlife crisis.

As Federal Reserve signals indicate rate cuts are likely in the coming months, many CD holders face reinvestment at lower yields. As a result, the real issue isn’t returns. It’s regret.

📉 What It Actually Is: Financial Whiplash

We tracked 72 hours of bank calls, 50 Reddit threads, and one emotional breakdown — because someone had to.

The truth?

Your CD maturity isn’t a decision.

It’s emotional torture.

It’s analysis paralysis.

It’s staring at a 4.5% rate that will soon be 3.0% — and wondering if you’re a genius or a fool.

- One woman: Reinvested immediately. Rate dropped the next day. She framed the confirmation email: “I beat the system.”

- Another: Waited 48 hours. Got 0.75% less. She now calls it “the Great Yield Betrayal.”

- And a classic: A man withdrew his $80,000, bought a motorcycle, and said: “At least I’ll be free when the economy crashes.”

We asked a financial planner: “Should people reinvest before rate cuts?”

They said: “It depends. But panic never helps.”

In contrast, we asked a Reddit trader.

They said: “Bro, if you’re not day-trading CDs, you’re leaving money on the table.”

Guess which one has 300K followers?

As The New York Times notes, CD rates peaked in early 2024. Now, with rate cuts looming, many savers face lower returns. As a result, the real cost isn’t financial. It’s psychological.

🔍 The Top Options: A Painful Countdown

After deep immersion (and one failed attempt to “time the market”), we present the **Top 5 Most “Strategic” Moves When Your CD Matures Before Rate Cuts**:

- #5: “The Immediate Reinvestor”

Locks in the last high rate. Feels like a winner. Also, might have missed a 0.1% bump next week. - #4: “The Wait-and-See Gambler”

Holds cash for “a few days.” Rates drop. They now call it “a long-term liquidity strategy.” - #3: “The Panic Withdrawer”

Takes the money out, keeps it in a savings account at 0.01%. Says: “I’ll decide later.” Never does. - #2: “The Lifestyle Inflater”

Buys a boat, a dog, or a timeshare. Justification: “The Fed stole my yield.” - #1: “The CD Hoarder”

Withdraws the money… then opens a new CD at a lower rate. Says: “I’m still in the game.” The game: losing.

These moves weren’t just financial.

They were epically emotional.

But here’s the twist:

They were also avoidable.

Because in personal finance, timing is a myth — but regret is real.

💸 The Hidden Costs: Your Sanity, Your Time, Your Dignity

So what does this decision cost?

Not just interest (obviously).

But your mental peace? Your time? Your ability to look at a bank statement without sweating?

Those? Destroyed.

The Regret Tax

We tracked one retiree’s CD decision for 72 hours.

At first, he was calm.

Then, he refreshed the Fed website 47 times.

Before long, he called three banks for “rate checks.”

Consequently, he reinvested at 4.25%.

Hence, the next day, rates dropped to 3.9%.

As such, he celebrated.

Furthermore, a week later, one bank offered 4.3%.

Ultimately, he started a blog: “My Yield Was Stolen.”

As a result, it has 12 readers. All are angry.

Meanwhile, Google searches for “how to time CD rates” are up 500%.

In turn, “CD panic” TikTok videos are trending.

On the other hand, searches for “index funds” remain low.

The Identity Trap

One of our writers said: “I feel like I failed my CD” at a dinner party.

By dessert, the conversation had escalated to:

– A debate on “when saving becomes hoarding”

– A man arguing that “cash is the ultimate asset”

– And someone yelling: “If you don’t maximize yield, you’re subsidizing inflation!”

We tried to change the subject.

Instead, they played a 10-minute audio of interest rate graphs rising and falling.

Ultimately, the night ended with a group whisper: “The Fed is watching.”

As such, three people checked their accounts at midnight.

In contrast, the host started a “Rate Watch” newsletter.

Hence, the anxiety had gone viral.

As CNBC reports, experts expect rate cuts to begin in Q3 2024. Savers with maturing CDs should consider laddering or alternative investments. As a result, the real issue isn’t timing. It’s expectation.

👥 Who Is This For? A Field Guide to the Rate-Anxious

Who, exactly, needs to suffer through the cd account matures before rate cuts crisis?

After field research (and one failed CD ladder), we’ve identified four key archetypes:

1. The Yield Maximizer

- Age: 50–75

- Platform: Bank, spreadsheet

- Motto: “Every basis point matters.”

- Tracks rates daily.

- Feels personal betrayal when rates drop.

2. The Panic Planner

- Age: 30–55

- Platform: Reddit, financial forums

- Motto: “I’ll optimize later.”

- Delays decisions.

- Eventually makes emotional ones.

3. The Lifestyle Escapist

- Age: 40–65

- Platform: Dealership, travel site

- Motto: “If the bank won’t pay me, I will.”

- Withdraws funds for “treats.”

- Says: “I earned this.”

4. The Accidental Participant

- Age: Any

- Platform: Group texts

- Motto: “I just wanted to know what to do.”

- Asked about CD rates.

- Now receives “market alerts” at 2 a.m.

This isn’t about money.

It’s about control.

About security.

About needing to believe you can outsmart the economy — even when you can’t.

And if you think this obsession is unique, check out our take on the Ozarks prison escape — where a spoon beat security. Or our deep dive into Seattle’s 90-second heist — where speed beat locks. In contrast, the CD rate crisis isn’t about returns. It’s about the illusion of control.

🧠 Conclusion: You Can’t Time the Market — But You Can Breathe

So, should you panic when your cd account matures before rate cuts?

No.

But also… your feelings are valid.

No — holding cash won’t beat inflation.

As a result, buying a motorcycle won’t fix uncertainty.

Instead, real financial peace comes from perspective.

Ultimately, CDs are one tool.

Hence, the real power isn’t in timing.

It’s in consistency.

Consequently, the next time your CD matures?

Therefore, don’t rush.

Thus, don’t freeze.

Furthermore, consider laddering, bonds, or simply withdrawing what you need.

Accordingly, accept that you won’t get the top rate forever.

Moreover, stop refreshing the Fed website.

However, in a culture that worships optimization, even saving becomes stressful.

Above all, we don’t want peace.

We want perfection.

As such, the panic will continue.

Moreover, the rate drops will come.

Ultimately, the only real solution?

Breathe.

Act.

And maybe… just let it go.

So go ahead.

Stress.

Refresh.

Overthink.

Just remember:

Your CD doesn’t define you.

And peace is worth more than 0.5%.

And if you see someone crying over a 4.25% rate?

Don’t judge.

Instead…

offer them a calculator — and a hug.

The Daily Dope is a satirical publication. All content is for entertainment purposes. Any resemblance to real financial advice is purely coincidental — and probably why we all need a therapist and a financial planner.

1 Comment

ftrKDbRZClkIVBuJAltiu