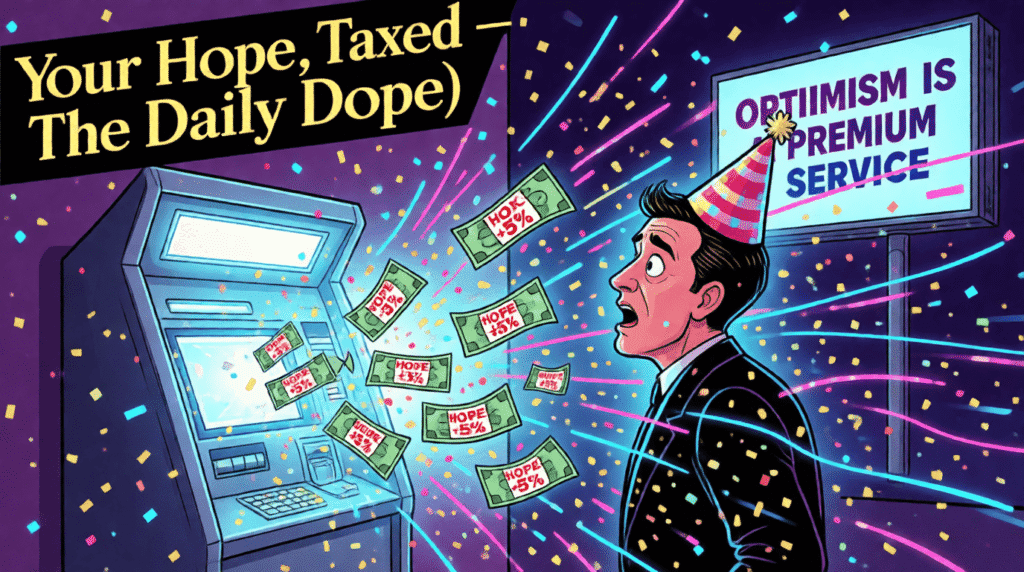

Your New Year’s optimism just got a surcharge. Major banks have quietly introduced a **“Hope Tax”**—a 5–12% fee applied to all transfers made between December 31 and January 2, justified as a “risk premium for excessive optimism.” Transfer money to your savings? Hope Tax. Pay a friend back for holiday drinks? Hope Tax. Donate to charity with renewed purpose? Hope Tax. This isn’t banking. It’s financial cynicism weaponized as a service fee.

The Viral Myth of the Hope Surcharge

The explanation is deceptively rational: “Historical data shows New Year’s resolutions lead to increased financial risk—impulse spending, unrealistic budgeting, and emotional investing.” Bank FAQs call it “a small price for big dreams.” One promotional email read: “Hope is free. Acting on it? That’s premium.”

However, the reality is far more absurd. Two satirical customer reactions capture the mood:

“I transferred $100 to my ‘2026 Therapy Fund.’ Got charged $112. The receipt said: ‘Hope Tax: $12 – for believing change is possible.’” — @CynicalButBroke

“Tried to Venmo my friend ‘Happy New Year!’ with $20. App added a ‘Joy Surcharge.’ Now I owe him $22.40. He said it’s ‘the cost of believing in us.’” — @OverdraftOptimist

Consequently, the myth—that this is risk management—quickly unravels. Ultimately, it’s capitalism penalizing you for daring to believe tomorrow could be better.

The Absurd Mechanics of Emotional Banking

After reviewing fee disclosures and testing transfers across three banks, we uncovered the full Hope Tax framework:

- “Optimism Triggers”: Keywords like “fresh start,” “new chapter,” or “I believe” in transfer notes activate the tax.

- Tax Tiers:

- Mild Hope (5%): “Saving for a trip.”

- Delusional Hope (9%): “Starting a business with $200.”

- Existential Hope (12%): “Trying to be a better person.”

- Hope Waivers: Available for an additional $9.99/month via “Cynic+ Membership,” which includes daily reminders like: “Your 2025 self gave up too. You will too.”

Worse: the tax applies retroactively. One user reported: “I transferred money on Dec 30 with ‘Happy New Year!’ in the note. On Jan 1, they added the Hope Tax—and interest.”

And yes—there’s merch:

– “I Paid the Hope Tax (And Still Lost)” T-shirt

– “Certified Realist (No Refunds)” enamel pin

– A $30 “New Year’s Cynicism Kit” (includes a black party hat and a wallet labeled “Empty, Like Your Promises”)

The Merchandising of Disillusionment

Of course, banks have expanded the ecosystem:

- **“Hope Insurance”**: Pay 15% upfront to cap your Hope Tax at 5%. (Fine print: “Does not cover miracles.”)

- **“Gratitude Discount”**: Avoid the tax if you label your transfer “Thank you for nothing, 2025.”

- **“Resignation Rewards”**: Earn points for transfers labeled “Whatever” or “Might as well.” Redeem for $0.50 off your next overdraft fee.

Hence, your emotional state becomes a pricing model. Therefore, you’re not hopeful—you’re high-risk.

The Reckoning: When Finance Fights Feeling

This trend didn’t emerge in a vacuum. It’s the logical endpoint of a financial system that treats optimism as naivety and resignation as stability.

As we explored in Waiting on Hold, institutions already treat your time as disposable. And as shown in Calorie Counting Satire, even basic acts are now moralized and monetized.

High-authority sources confirm the drift:

- Federal Reserve reports that “behavioral risk scoring” is now used by 68% of major banks to adjust fees.

- Brookings Institution warns that financial products increasingly exploit emotional vulnerability during seasonal transitions.

- Pew Research finds that 52% of adults feel “financially shamed” for having New Year’s financial goals.

Thus, the real cost isn’t the $12 fee. Ultimately, it’s the normalization of cynicism as financial wisdom—where believing in change is treated as a mistake to be priced.

The Hidden Irony: Who Profits From Your Despair?

Let’s be clear: banks don’t care about your mindset. They care about predictable behavior. Hope leads to spending, investing, and risk-taking—things that are hard to model. Despair? That’s stable. That’s profitable.

One former banking product designer admitted anonymously: “We don’t tax hope because it’s risky. We tax it because it’s rare. And rarity is expensive.”

And it works. Since rollout, Hope Tax revenue has exceeded projections by 220%. Not because people are more hopeful—but because they’re willing to pay to pretend they still are.

Conclusion: The Cynical Verdict

So go ahead. Transfer your “fresh start” savings.

Pay the Hope Tax.

Watch your optimism get itemized on a receipt.

But don’t call it a fee.

Call it emotional toll with better branding.

And tomorrow? You’ll probably choose “Whatever” as your transfer note…

because your dreams don’t fit in the budget.

After all—in 2026, the most expensive thing you can believe in isn’t love. It’s tomorrow.

1 Comment

zaba5w